On Oct. 4, a day of heightened concerns about international terrorism, the 1st U.S. Circuit Court of Appeals heard a multipronged appeal concerning three men charged with giving false information to the Internal Revenue Service about a charity allegedly connected to jihadist fighters and the mujahedeen. Although the charges stem from tax law, the case has drawn national attention, because of concerns about terrorism, and attracted major legal talent: One of the defendants is represented by Kathleen Sullivan, a name partner and head of the national appellate practice at Quinn Emanuel Urquhart & Sullivan.

Sullivan represents Emadeddin Muntasser, who founded Care International Inc., a Massachusetts charity, in 1993. At the time, it billed itself as assisting victims such as widows and orphans of "man-made disasters" or wars, in such countries or regions as Afghanistan, Bosnia and Kashmir. The indictment accused the defendants of hiding Care's solicitations of funds for, and publications supporting, Islamic holy war -- "jihad" -- and holy warriors -- "mujahedeen" -- from 1993 to 2003. Sullivan said that her firm has represented Muntasser since 2008 in all post-trial proceedings in this matter as part of its white-collar defense practice: "My Quinn Emanuel partners Faith Gay and Susan Estrich worked with me to win Mr. Muntasser's successful post-verdict judgment of acquittal from Judge Saylor on all the tax counts. Today we defended that victory and sought to overturn the remaining conviction and sentence on the one false statement count."

Harvey Silverglate, of counsel to Boston's Zalkind, Rodriquez Lunt & Duncan, argued the pretrial motions to dismiss at the lower court. He said he brought Sullivan into the case for the appellate argument because it was "partly a constitutional case."

"It involved incredible overreaching by the government and twisting of a vague statute," Silverglate said.

In a 75-minute hearing, the court considered appeals of three related cases: U.S. v. Muntasser; U.S. v. Mubayyid; andU.S. v. Al-Monla. Muhamed Mubayyid and Muntasser appealed their convictions. The government cross-appealed their sentences and their acquittals on conspiracy charges. The government also appealed the lower court's judgment of acquittal for Samir Al-Monla.

Muntasser ran Care until 1996. Mubayyid served as the organization's volunteer treasurer from 1998 to 2002. Al-Monla was president of Care in 1996 and 1997 and treasurer in 1998.

Mubayyid was sentenced in June 2008 to 11 months in prison and three years of supervised release for a scheme to conceal information from the IRS, three counts of filing of false tax returns and one count of obstruction of the IRS. A jury also convicted Mubayyid of conspiracy to defraud and impede the IRS, but Judge Dennis Saylor IV of the District of Massachusetts granted his motion for acquittal on that count.

Also in June 2008, Saylor sentenced Muntasser to a year in prison, plus three years of supervised release for making a false statement to an FBI agent -- that he never traveled to Afghanistan. Saylor also granted Muntasser's motion for acquittal after the jury convicted him of a scheme to conceal material facts and conspiracy to defraud the IRS.

A jury acquitted Al-Monla of making false statements to the FBI and convicted him for scheme to conceal and conspiracy to defraud the IRS. In June 2008, Saylor entered a judgment of acquittal for Al-Monla on those charges.

Sullivan argued that the government was advancing a new theory on appeal. The government's new argument, Sullivan said, is that the defendants were guilty of a conspiracy to maintain tax-exempt status. The government's earlier theory was that the defendants engaged in a conspiracy to first fraudulently obtain, then maintain, tax-exempt status.

Circuit Judge Kermit Lipez said the maintaining argument relates to four Form 990s, which are tax forms filed by tax-exempt organizations, at issue in the case, and related false statements. "Those charges were front and center throughout the trial," Lipez said. "It seems to me that the maintaining portion [of the case] was front and center throughout the trial."

Sullivan countered by noting that Care's efforts relating to obtaining tax-exempt status "dominates the discussion of conspiracy." Even if the change in theory is a nonprejudicial variance, the government's evidence is insufficient for its case against Muntasser, Sullivan said.

Sullivan said there's only one page in the entire transcript linking Muntasser to the conspiracy to maintain Care's tax-exempt status. "The count 6 false statement charge for Mr. Muntasser is not a slam dunk for government," Sullivan said.

Mubayyid's lawyer, Michael Andrews, a Boston solo practitioner, said his client wasn't involved with the formation of Care. Mubayyid was a volunteer treasurer several years later and there's no proof he knew what was in Care's application for tax-exempt status in 1993.

The government's case asks the court to create a duty, Andrews said. "This nation has thousands of small charities," he said. "What the government seeks to do to impose a rule, on penalty of criminal incarceration, that if you volunteer, you have an obligation to go back and look at the founding documents and see what is declared and [also look at] any other correspondence to the IRS."

"What is wrong with that?," countered Judge William Smith of the U.S. District Court for the District of Rhode Island, who sat by designation on the panel. "[Without such rules], if you want to avoid disclosing that you've converted your nonprofit into a different kind of entity, all you have to do is get a volunteer treasurer," Smith said. "I don't see what's so bad that someone who signs those forms [and attests] that they're true has an obligation to go back and ensure it."

It will have "an incredibly chilling effect on charities," Andrews said. "Who would want to risk prosecution?" he asked. "If the government had evidence that someone was told 'Don't look at prior filings,' there's room for [charges of] willful blindness and room for [charges of] intentional deceit. That's not what happened here."

The government's lawyer, S. Robert Lyons, a Justice Department tax attorney, said Care solicited donations and promised the money would be used for jihad and the mujahideen.

"Supporting jihad and mujahideen permeated Care's activities and purpose, but if you look at the IRS tax forms Care filed, the words jihad and mujahideen appear not once," Lyons said.

Lyons noted that the jury found that forms were false because there was a conspiracy to deceive the IRS. He also said Care deceived the IRS by not disclosing that it was an outgrowth of the Al-Kifah Refugee Center, which supported jihad and mujahideen and published a pro-jihad newsletter. "They hid the fact that the only thing Care was [was] Al-Kifah under a different name with a request for tax-exempt status," Lyons said.

Lipez asked Lyons if the government complicated its case by building so much of its case on the deception in Care's initial filing for tax-exempt status. "Why did you, knowing of the statue of limitations problem?," Lipez asked.

Lyons responded that it was the government's position that it proved the conspiracy continued beyond the initial filing for Care's tax-exempt status. He also said that although the court found that Muntasser acted alone when he filed for Care's tax-exempt status, the government accepts it as a matter of appeal but not as a matter of fact

Smith asked Lyons to respond to Sullivan's point that a defendant is entitled to construct a defense that anticipates and takes into account what the government has actually charged.

Lyons replied that the government would have put on the exact same evidence in the case if the indictment had been written to indicate the conspiracy to deceive the IRS began some time after Care filed to obtain tax exempt status.

Later, Smith asked Al-Monla's lawyer, Judith Mizner, the chief of the appeals unit at the Federal Public Defender's Office in Boston, to address the government's argument that the case "wouldn't have been different if it charged [defendants] with a conspiracy to maintain a previously falsely obtained tax exempt status."

Mizner replied its not clear all of the evidence would have been in the same format and that it's up to the government to make its best case at the outset.

"This court has said in the past it's not for the court to rescue the government from it's bad choices," Mizner said. "It's a question of the sufficiency of the evidence to prove what they charged."

skip to main |

skip to sidebar

Civil trial attorney Baruch C. Cohen holding a Kassam rocket that Hamas fired into Sderot

A Los Angeles litigator courageously stands in solidarity with Israel: channeling his aggressive zealous advocacy on behalf of Israel. Defending the State of Israel's: right to exist, right to protect her citizens from terrorism, right to defend her borders from hostile enemies. Prosecuting and impeaching Israel's defamers.

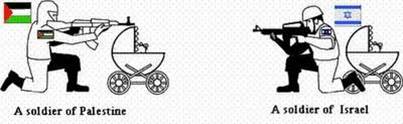

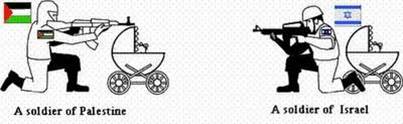

SOLDIERS OF IDF VS ARAB TERRORISTS

About Baruch Cohen

Loyal Pro-Israel Followers

Labels

- 'CIA' now stands for Center for Islam in America

- 'Palestinians' out of money again

- " just fix the Palestinian problem

- "Death to Israel" song on Hamas TV half-hour before station destroyed

- "No" is the real obstacle to peace

- “Palestine” Does Not Qualify as a “State”

- "Pro-Palestinian" really means "anti-Israel"

- @Amnesty and @HRW silent over Hamas triple-execution scheduled for tomorrow

- 000

- 000 Arabs

- 000 each

- 000 Each To Leave Gaza

- 000 Palestinians

- 1 Jew is worth more than 1

- 1925 Wakf Temple Mount Guide

- 1947 UN vote for the Partition of Palestine

- 2 Live Jews

- 2004 Knesset debate over the Gaza disengagement

- 2024 Olympics In Israel

- 3-D test for anti-Semitism

- 3D Topographical Map of Israel

- 40th Anniversary of Sadat's Visit to the Knesset

- 50 years of demonization and twisting of the truth

- 500 years of Jewish history

- 8th Day

- 9-11

- 9/11

- 96% of the FBI’s Most Wanted Terrorists are Muslim

- A Nuclear-Capable Iran is a Threat to America

- A Tree for Every Rocket

- A.K.A. Pella

- Aaron David Miller

- Aaron Feuerstein

- Aaron Liberman

- Aaron Razel

- Abayudaya of Kahal Kadosh She'erit Yisrael (remnants of Israel)

- Abba Eban

- Abbas Appointee: Jews are usurers who control the money the press and the resources

- Abbas Arrests Woman who Flamed him on Facebook

- Abbas has been lying about the origins and history of the conflict

- Abbas has done nothing but inspire this rampant culture of hate

- Abbas refuses to stop salaries to terrorists

- Abbas Responsible for High Salaries to Terrorists

- Abbas was Always Anti-Semitic

- Abbas Will Never Make Peace With Israel

- Abbas' appointee: Israel uses sex to fight Arabs and Muslims

- Abbas's "Culture of Peace" Bassam Tawil

- Abdulateef Al-Mulhim

- Abie Rotenberg

- Abish Brodt

- Abraham Bell

- Abu Hasira

- Academics looking the other ignoring Arab terrorism

- Acheinu

- Actors boycotting Israel

- Adam Milstein

- Adelle Nazarian

- Adi Ran

- ADL

- Admiral Mike Mullen

- Adolph Eichman

- Adolph Hitler

- Adopt-a-Soldier of the IDF and pray for his or her welfare

- Advocating Boycotts

- African American Zionist Dumisani Washington

- Against All Odds

- Agudath Israel of America

- Aharon HaKohein's grave in Jordon

- Aharon KaKohein's Yahrtzeit

- Ahed Tamimi

- Ahmad Qrei Abu Ala

- Ahmadinejad

- Ahmadinejad called Israel a cancerous tumour

- Ahmadinejad is Hitler

- Ahmadinejad Is Irrelevant

- Ahmadinejad is violating the UN Charter calling for the destruction of the State of Israel

- Aid money to the Palestinians is not being carefully scrutinized nor administered

- Ain Od Milvado

- AIPAC

- Airbnb’s Anti-Israel Hypocrisy

- Aish HaTorah

- Aish Kodesh

- AKA Pella

- aka Timnat Heres

- Akeidas Yitzchok

- Al Dura hoax

- Al-Qaeda recruiting children

- Al-Qaeda's bomb-making manual

- Alan Dershowitz

- Alex Grobman

- Alice Herz Sommer

- Allah tells us Jews are liars

- Allies knew of Holocaust in 1942

- Altalena

- Alter of Slabodka

- Am Yisrael Chai

- Amar Brothers

- Amar'e Stoudemire

- Amazing archaelogical finds in Israel

- Amazing Artistic collection of Reb Yakov Weisberg in Jerusalem Meah Shearim

- America must prosecute the Arab terrorists who killed american citizens

- America sold Israel Bunker-Buster bombs

- America's insistence that Israel release Palestinian terrorists

- American Arabs supporting terrorists

- American cities becoming sister-cities to Israeli cities

- American citizen has reportedly been arrested by the Palestinian Authority over suspicion he was involved in selling property to Jews in eastern Jerusalem

- American companies investing in Israel

- American Embassy must be in Jerusalem

- American Freedom Alliance

- American Freedom Defense Initiative

- American Friends of Magen David Adom

- American Jewish support for Israel

- American Jews

- American Jews boycotting Israeli settlements is terribly wrong

- American Jews making Aliyah

- American Jews protecting themselves from Moslem attacks

- American Jews volunteering for Israel

- American Jihadist

- American media tries so hard to present Iran in a positive light

- American military bases in Israel

- American Nazis

- American pilots who volunteered to defend Israel in battle

- American presidents and their relationships with Israel

- American Presidents who visited Israel

- American Religious Zionism

- Americans converting to Islam

- Americans who make Aliyah must still file US tax returns

- Ami Horowitz

- AMIT

- Amitzur Nachshoni

- Ammar al-Hamadani

- Amnesty International Blind to Jewish Blood

- Amnesty International Condones Killing of Settlers

- Amos Yadlin

- Amukah

- and Norway behind center named after terrorist murderer Dalal Mughrabi

- Andrea Bocelli

- Andrew Breitbart

- Andrew Klavan

- Andrew Roberts

- Ann Barnhardt

- Anne Bayefsky

- Anne Frank

- Annexing Judea and Samaria

- Annual International Temple Mount Awareness Day

- Anthony Weiner

- Anti-American Jihad

- Anti-Arab Racism in Israel

- Anti-Israel Activist

- Anti-Israel campaigns on American college campuses

- Anti-Israel hate sites on Facebook

- Anti-Israel postage stamps from Arab countries

- Anti-Israel Propaganda

- Anti-Israel Propaganda Creeps Into World of Grand Opera

- Anti-Israel rallies

- Anti-Orthodox animus

- Anti-Semites who learn they are Jewish

- Anti-semitic cartoons

- Anti-Semitic items sold on Amazon

- Anti-Semitic material in Arab textbooks

- Anti-Semitism

- Anti-Zionism is Anti-Semitism

- Anti-Zionist and Anti-Semitic graffiti

- Antiniya Rebbe

- Anwar al-Awlaki: the “Bin Laden of the Internet”

- Apartheid in Lebanon

- Apple's Third Intifada

- Aqsamobile!

- Arab "price tag" and arson attacks ignored by the media

- Arab Apartheid

- Arab artwork that shows Israel as a monster that stabs and eats people

- Arab Barbarism

- Arab big talk

- Arab blood libels

- Arab bogus cemeteries

- Arab boycott of American goods

- Arab Brutality

- Arab Cease-Fire is a Ruse

- Arab censorship

- Arab Charities Fund Terror

- Arab children love martyrdom

- Arab Christians fighting for Israel

- Arab conditions before negotiations for peace

- Arab Crossword puzzles

- Arab culture of Death

- Arab desecration of Jewish cemeteries

- Arab Dictators

- Arab discrimination and abuse against Palestinians

- Arab donors renege on pledges to PA

- Arab duplicity

- Arab employment from Jews

- Arab fathers do not want their Jewish children

- Arab Forcible Virginity Test

- Arab Global March to Jerusalem

- Arab hackers

- Arab Hatred for Jews

- Arab hatred of Jews

- Arab hospital in Jerusalem stops accepting patients because PA leaders prioritize paying terrorists over medicines

- Arab hypocrisy on Libya

- Arab Knesset members

- Arab Land Theft in Israel

- Arab Leaders fail to object to anti-semitic acts

- Arab leaders' corruption

- Arab League boycott

- Arab lies

- Arab Lobby

- Arab Media Manipulates News

- Arab media presenting children who claim that Christians and Jews are inferior cowardly and despised

- Arab men financially exploiting their wives

- Arab MK Wants Punishment to ‘Nakba Deniers’

- Arab mothers wishing their children holy martyrs

- Arab Nuremberg laws

- Arab paranoia

- Arab pedophilia

- Arab Persecution of Christian

- Arab prisoners of Israeli prisons have it made

- Arab Propaganda

- Arab provocateurs

- Arab Racist Cartoons Against Israel

- Arab refugees of their own making

- Arab refusal to recognize Israel

- Arab Savages

- Arab slave trade of women

- Arab Smuggling weapons through tunnels

- Arab spies for the CIA

- Arab spring has revealed the true face of the Arabs

- Arab squatters on Jewish-owned land in Israel

- Arab support of Terror

- Arab Takeover

- Arab terror snow sculptures

- Arab Terrorism

- Arab terrorism kills Arabs too

- Arab terrorist leaders hiding out in caves

- Arab Terrorist Summer Camp for Children

- Arab terrorists cut down the power lines

- Arab terrorists die in their own underground tunnels from their collapse and poor construction

- Arab terrorists disguise themselves as civilians

- Arab Terrorists hacking into Israeli military computers

- Arab terrorists targeting school kids

- Arab terrorists use journalists as human shields

- Arab TV series inciting hate against Jews

- Arab War Crimes

- Arab Wife-Beating

- Arab women terrorists

- Arab-Nazi Alliance

- Arab's Barbaric Modesty Police

- Arabic Baby Names revering violence and death

- Arabic media is so overwhelmingly obsessed with reporting on Palestinian Arabs as "martyrs"

- Arabs accusing Israel of being paranoid

- Arabs accusing Israel of sending prostitutes with AIDS to infect Palestinians

- Arabs accusing Israel of spying

- Arabs accusing Israel of war crimes

- Arabs and Jews have not lived in peaceful coexistence

- Arabs and Muslims are really obsessed with Tom and Jerry

- Arabs and pornography

- Arabs are not interested in peace

- Arabs are their own worst enemies

- Arabs Attack Worshipers at Kotel

- Arabs attacking Jewish doctors and Israeli ambulances

- Arabs barring Jews from Jewish cemeteries

- Arabs blaming Hamas for the killing and destruction they suffered

- Arabs blaming Israel for killing Arafat

- Arabs Blaming Israel rather than fixing their own cultures

- Arabs blaming Israel to mask their own deficiencies and to distract and rally public opinion

- Arabs bombing Israeli civilian towns

- Arabs Boycotting Israel

- Arabs bragging about terrorism

- Arabs building illegally in Israel

- Arabs burning the Israeli Flag

- Arabs calling Obama a scumbag

- Arabs celebrating terrorism against Israel

- Arabs celebrating the murder of Jews

- Arabs chose being victims

- Arabs claim that Pepsi is an acronym for Pay Every Penny to Save Israel

- Arabs claim that Pepsi is an acronym for Pay Every Pound for the Security of Israel

- Arabs claiming that Hurricane Sandy is divine punishment against US' support of Israel

- Arabs claiming that the Jews built the gas chambers of Auschwitz

- Arabs Complain About Bar Mitzvahs At Kotel

- Arabs crossing Israel's borders

- Arabs Culture of Hatred and Violence

- Arabs dating Jewish women to convert them to Islam

- Arabs defiling Temple Mount

- Arabs Denying the Holocaust

- Arabs Desecrate Temple Mount With Violence

- Arabs devaluing women

- Arabs discriminating against Arabs

- Arabs disrupting Pro-Israel events

- Arabs do not live in "shanties"

- Arabs do not want peace

- Arabs drinking camel urine

- Arabs erasing Israel from maps and textbooks

- Arabs extolling terrorism

- Arabs fear Moshiach

- Arabs fighting arabs

- Arabs fighting black magic

- Arabs for Israel

- Arabs forcing women to wear Niqabs

- Arabs harassing pro-Israel speakers

- Arabs hate Jews

- Arabs hiding behind civilians

- Arabs hiding rocket launchers in garbage trucks

- Arabs hiding rocket launchers in Palestinian school yards

- Arabs honoring arch-terrorist by proudly listing their murders

- Arabs honoring Bin Laden

- Arabs honoring terrorists

- Arabs in Israeli Hospitals

- Arabs in the IDF

- Arabs insulting Arabs by calling them Zionists

- Arabs kill Arabs and it's all the Jews' fault

- Arabs killed by their own celebratory gunfire

- Arabs killing arabs accused of collaborating with Israel

- Arabs killing their children for not learning the Koran

- Arabs killing their own

- Arabs know how to insult

- Arabs launching rockets near children's nursery schools and kindergartens

- Arabs Live Better Under Israeli Rule Than Under Arab Rule

- Arabs love death

- Arabs love death more than Israelis love life

- Arabs lying about military victories

- Arabs lying that Israel Spreads Drugs and AIDS in Egypt

- Arabs marrying little girls

- Arabs memorize the Quran to get out of jail in Saudi Arabia

- Arabs Mutilating children's genitalia

- Arabs naming streets after Anti-Israel prvocateurs

- Arabs naming streets after terrorists

- Arabs naming summer camps after terrorists

- Arabs never denounce terror attacks

- Arabs offering money to Arabs killed committing terrorism against Israel

- Arabs Paying terrorists

- Arabs portraying Israel as an oppressor and an occupier without respecting Israel's legitimate rights and fears in a region where her neighbors actively call for her destruction

- Arabs praising Hitler

- Arabs praising the Jews of Palestine

- Arabs preaching Genocide

- Arabs prefer life in Jewish state

- Arabs punishing those who spy for Israel

- Arabs refuse to shake Israeli hands

- Arabs refusing the Red Cross to visit captured Israeli Soldiers

- Arabs refusing to meet with Jews

- Arabs refuting Jewish claims to the Western Wall

- Arabs rejected peace deal after peace deal

- Arabs rejoicing at Israeli tragedies

- Arabs Rewriting History

- Arabs rioting

- Arabs Sending Children to Provoke and Be Killed by Israeli Soldiers

- Arabs sending millions of martyrs to Jerusalem

- Arabs serving in the Israeli Army

- Arabs smuggling explosives as cancer medicine

- Arabs staging bogus deaths to elicit media sympathy

- Arabs stating that Zionism is a virus that infects humanity

- Arabs Stoning Jewish Drivers

- Arabs targeting innocent civilians

- Arabs Threatening Israel's Destruction

- Arabs throwing rocks at Israelis

- Arabs throwing rocks at Israerlis

- Arabs torturing animals

- Arabs Training Children to Commit Terror

- Arabs translating the Talmud to understand the evil that is Israel

- Arabs treating Palestinian Arabs like garbage

- Arabs try to attack Israelis whenever they can

- Arabs urge that suicide bombings are a religious duty

- Arabs urging Arab drivers to perpetrate Martyrdom Operations

- Arabs Vandalizing Jewish Cemeteries and Holy Sites

- Arabs want Israel Judenrein

- Arabs whipped into a frenzy by Hamas

- Arabs who sell property to Jews are threatened by Arabs

- Arabs wishing to be martyrs

- Arabs with money to waste

- Arabs' "NO" to Israel

- Arabs' Abuse of Children

- Arabs' camel beauty contest

- Arafat brought ruin to the Palestinians

- Arafat died from AIDS

- Arafat planned and led the Intifada

- Arafat premeditated the Second Intifada

- Arafat received a standing ovation at the UN

- Archaeology that confirms the destruction of the Bais Hamikdash

- Ari Boiangiu

- Ari Fuld

- Ari Goldwag

- Ari Lesser

- Ari Mandelbaum

- Ari Zivotofsky

- ariel sharon

- Ariel Zilber

- Arizal Rav Yitzchak Luria

- Artwork that confirms the destruction of the Bais Hamikdash

- Arutz Sheva

- Aryeh and Gil Gat

- Aryeh Eldad

- Aryeh King

- Aryeh Kunstler

- As Gaza sends rockets to Israel -Israel sends food and fuel to Gaza

- As Trump meets Abbas in Bethlehem the PA names squares after murderers

- Asl al-Yahud - Origins of the Jews in Arab lands

- Asma Assad

- Asymmetrical Prisoner Exchanges

- Ateret Cohanim

- Ateret-Cohanim

- Athletes boycotting Israel

- Atlas Shrugs

- Attack on Israel Is Attack on US

- Attorney General Eric Holder decided not to prosecute the Council on American Islamic Relations

- Attorney General Eric Holder refused to hand over documents about the Muslim Brotherhood network in the U.S.

- Auschwitz

- Auschwitz Numbers Tatoos

- Austere Challenge 2012

- Avi Perets

- Avi Piamenta

- Avigdor Lieberman

- Avishai Rosen

- Avital Chizhik

- Avraham Rosenblum

- Avrohom Fried

- Avrohom Rosenblum

- Avromi Rot

- Avrumi Roth

- Ayaan Hirsi Ali

- Ayatollah Khamenei is the next Hitler

- Bais Din

- Bais Hamikdash

- Baladia City Israel - Urban War Games

- Balfour Declaration

- Barak Obama

- Bark Mitzvah

- Barry Rubin

- baruch

- Baruch ben David Mizrachi

- Baruch Bina

- Baruch C. Cohen

- Baruch C. Cohen. Paul Jeser

- Baruch Chait

- Baruch Levine

- Baruch Marzel

- Bashir Assad

- Bassam Tawil

- BBC's anti-Israel bias

- BDS movement is not merely against occupation but against the very existence of Israel itself

- BDS Sewer System

- BDS’ Immoral Deceptions

- BDS'ers are violent

- BDSers celebrate being Idiots

- Bedouins illegally building villages throughout the entire Negev

- Behind the Smoke Screen

- being perpetrated by Muslims

- Beit Orot

- Beit Schechter

- Beit Shechter

- Belief in G-d After the Holocaust

- Belz

- Ben Brafman

- Ben Ish Chai

- Ben Shapiro

- Ben Snoff

- Ben Snuf

- Ben-Dror Yemini

- Benjamin Brafman

- Benjamin Netanyahu

- Benny Begin

- Benny Friedman

- Benny Gantz

- Benny Morris

- Bentzi Marcus

- Bentzion Oring

- Bentzy Marcus

- BenYomen

- Beri Weber

- Bernanrd Henri-Levy

- Bernd Wollschlaeger

- Beth Jacob Congregation (Beverly Hills

- Beyond the Green Line

- Bi-Annual Robotics Conference in Herzliya

- Biala Rebbe

- Bible Codes

- Biblical Israel

- Biblical Prophecies Fulfilled

- Bigotry behind demands to freeze construction

- Bikur Cholim Hospital

- Bill Clinton slams Yasser Arafat for Rejecting Peace

- Bill Handel

- Bill Maher

- Bill O'Reilly

- Bill Warner

- Billionaire Israelis

- Billy Crystal

- Billy Joel

- Bilvavi Mishkan Evneh

- Binyomin Lerner

- Birchat Kohanim at the Kotel

- Bitachon

- Black anti-semitism

- Black Jews

- Blaming Israel for 9/11

- Blaming Israel for Middle East problems is anti-Semitism

- Blaming Israel for terrorist attacks on Israel

- Blaming the Jews and Scapegoating

- Bnei Akiva

- Bnei Menashe

- Bob Costas

- Bob Dylan

- Bob Siegel

- Bobover Rebbe

- Bomb Gaza

- Bombing of the British Military Intel HQ in the King David Hotel

- Bosch Fawstin

- Boycott Divestment Sanction Israel

- Boycotting Israel businesses

- Branko Lustig

- Brave Jews Pioneering Israel

- Breslev Brothers

- Breslov

- Bret Stephens

- Brig. Gen. David Laskov

- Brigitte Gabriel

- Bring Back Our Boys

- British banished Jews from Israel

- British Jews making Aliyah

- Brodt Brothers

- Building in Jerusalem is about Jewish rights

- Bulletproof Stockings

- Burka Fashion Show

- Burka Woman

- Business secrets of the Talmud

- but not to terrorist prisoners

- Buy Israeli products

- CA)

- CAIR Loses IRS Status

- CAIR's ties to terrorism and terrorists

- Cairo Geniza

- Caliber-3

- California Security Council

- Call a terrorist a terrorist

- Calls Trump ‘King of Kindness’

- CAMERA

- Camp Torah Vodaas

- Canada-Israel Alliance

- Canada-US Alliance

- Cantor Chaim Adler

- Cantor Netanel Baram

- Captain Israel

- Car Intifada

- Cardboard Khomeini

- Cardinal Rodriguez Maradiaga

- Carl Reiner

- Carmel Fires

- Carmi Schwartz

- Caroline Glick

- Carrie Zeidman

- Cash for Calm’ Ultimatum from Hamas

- Catholics discovering they are Jews

- celebr

- Centrality of the Temple Mount in Judaism

- Chabad

- Chabad dancers

- Chabad of Belaire

- Chabad Telethon

- Chai Lifeline

- Chaim David

- Chaim Gold

- Chaim Herzog

- Chaim Meir Erps

- Chaim Weitzman

- Chaim Yisroel

- Chanukah

- Charles Harary

- Charles Krauthammer

- Charles Ogletree

- Charlie Harary

- Chassidim in business

- Chassidim on TV

- Chassidisher Mitvah Tanz

- Chaya Schijveschuurder

- Chazon Ish

- Checking Arabs for bombs at military checkpoints

- Chevron is not a settlement

- Chevron Massacre

- Chief Rabbi Blesses Ivanka

- Chief Rabbi Lord Jonathan Sacks

- Children should be taught to love and respect

- Chilik Frank

- Chilu Posen

- China

- Chinese Jews make Aliyah

- Chinese perceptions of Jews

- Chloe Simone Valdary

- Chloé Simone Valdary

- Chofetz Chaim

- Choni G

- Chris Christie

- Christian Anti-Semitism

- Christian Arab youth who wish to serve in the Israel Defense Forces

- Christian Missionaries attempting to fool Jews about Jesus

- Christian Missionaries desecrating Torahs

- Christian Monastery at Auschwitz

- Christian Zionism

- Christians are infidels

- Chuck Devore

- Chuck Hagel

- Churches silent on massacre of Fogel family

- Churva Shul

- Circassian Sheikh Farok Zinadin

- Circling of Gates

- City of David - Ir David

- Civil and criminal liability to colleges that allow anti-semitic and anti-Israel hate groups to intimidate

- Civilian killed as rockets hit Israel's Ashkelon

- Cleaning the Kotel

- Cleaning the Kotel for Pesach

- Clueless Palestinian Supporters

- CNN's bias against Israel

- Co-existence between Jews and Arabs

- Code of Esther

- Code Pink calling for Intifada

- Coexistence between Jews and Arabs

- Col. Richard Kemp

- Come See Israel

- Committee for a Jewish Army

- Conference of Presidents

- Conflict between Israel and the Palestinian Authority is not over land but over Israel’s very existence

- Congregation Etz Chaim of Hakcock Park

- Congressional visits to Israel

- Congressman Ted Lieu

- Connection between Native Americans and the Ten Lost Tribes

- Cool Jew

- CoolJew.com

- Cory Booker

- Councillor Richard Humphreys

- Creation of the State of Israel

- Creative Zionist Coalition

- cufi

- Curtis Sliwa

- Dachau

- dAJUS

- Dan Gertler

- Dan Gillerman

- Dan Halloran

- Dan Lungren

- Dan Shapiro

- Dangers of Premature Recognition of a Palestinian State

- Daniel Ahaviel

- Daniel Ahviel

- Daniel Barenboim

- Daniel Gordis

- Daniel Greenfield

- Daniel Inouye

- Daniel Patrick Moynihan

- Daniel Pearl

- Daniel Pereg

- Daniel Pipes

- Danish agitators

- Danny Aayalon

- Danny Ayalon

- Danny Danon

- Danny Kay

- David Brooks

- David Cameron

- David Friedman

- David Green

- David Harris

- David Hazony

- David HeMelech

- David Horowitz

- David Machlis

- David Siegel

- David Suissa

- David Wolpe

- David’s Sling

- Dead Sea

- Dead Sea Scrolls

- Death to Jews

- Debbie Schlussel

- Deborah Lipstadt

- Debra Applebaum

- Dedi

- Dedy

- Defiant and unrepentant Arab terrorists

- Demian Kaus

- Democrats who regret supporting Obama because of his economic policies and his posture toward Israel

- Demonisation and Delegitimisation of Israel

- Demonstrators Tell Ahmadinejad to Go Home

- Dennis Miller

- Dennis Prager

- Deputy Bik’ah Brigade Commander Lt. Col. Shalom Eisner

- Der Strumer

- Derech Eretz

- Derisive response to PM’s exposé shows world still refusing to get real on Iran

- Descendants of Nazis

- DeScribe

- Desecrating Holocaust Memorials

- Desecration of Jewish graves in Europe

- Desecration of Torah Scrolls

- Desmond Tutu

- Destroyed Sifrei Torah

- Dialogue with Muslims won't quell Islamic Jew-hatred

- Diaspora Yeshiva Band

- digging on the Temple Mount Erase Traces of the Jewish Altar

- Dina Leeds

- Discovering Nazi antecedents

- Disengagement was a terrible mistake

- Disgusting marketing of the Holocaust

- Dishonest Reporting Awards

- Disney in Israel

- Disputation of Barcelona

- Divestment or Sanctions against Israel

- Divine punishment for expulsion from Gaza

- Dmitriy Salita

- Dome of the Rock in disrepair

- Don’t Rebuild Gaza

- Donations to Hezbollah bypass US-imposed sanctions

- Dore Gold

- double standard

- Double-Standard

- Dovid Dachs

- Dovid Gabay

- Dovid Moskovits

- Dr Alan Bauer

- Dr Meir Wikler

- Dr. Arieh Eldad

- Dr. Baruch Goldstein

- Dr. Bernd Wollschlaeger

- Dr. David Applebaum

- Dr. Irving Moskowitz

- Dr. Jaques Gautier

- Dr. Kobi Vortman

- Dr. Ludwig Guttmann

- Dr. Martin Luther King Jr. - A Supporter of Israel

- Dr. Rahamim Melamed-Cohen

- Dr. Seuss’s Anti-Hitler Political Cartoons for Adults

- Dream Doctors Project

- Dreidel-Palooza

- dry bones

- Dudu Fisher

- Duo Reim

- Durban III Racism Conference

- During the humanitarian truce Gazans moved rockets into a mosque

- Dveikus

- Economic Boon in Ramallah

- Ed Koch

- Edan Pinchot

- Eddie Cantor

- Edward G. Robinson

- Efraim Karsh

- Egypt banning exports of Lulavim

- Egypt ready to take on Hamas

- Egypt's Air Sinai

- Egyptian Anti-Semitism

- Egyptian blockade of Gaza

- Egyptian curricula states Jews

- Egyptian lawsuit against leaders who met with Jews

- Egyptian Muslim Brotherhood

- Egyptian Protesters Outside Israeli Embassy Bear Signs with Swastikas

- Egyptian siege of Gaza

- Egyptian site says Zionists are devil worshipers - and control the world

- Ehud Barak

- Eida HaChareidis

- Eitan Katz

- El Al security

- El-Al has the most attractive flight attendants

- Elan Carr

- Eldad Aizenman

- Elder of Ziyon

- Electromagnetic Pulse Attack

- Electronic SMS tracker notifies Saudi husbands when their wives leave the country

- Elevation Band

- Eli Avidan

- Eli Beer

- Eli Broad

- Eli Cohen

- Eli Dali

- Eli Schwebel

- Eli Streicher

- Elie Weisel

- Eliot Engel

- Eliran Elbaz

- Elisha Z and the Zakabeats

- Eliyahu Fink

- Elly Kleinman

- Elon Gold

- Elon Moreh tragedy

- Emergency Committee for Israel

- Enemies of Israel are Facebook buddies to one another

- Entertainers who perform in Israel and do not succumb to the pressure of the Arab Boycott of Israel

- Epic skimming is a common privilege of Middle Eastern despots

- Erev Rav

- Eric Cantor

- Erick Stackelbeck

- Erik Stakelbeck

- Esh Kodesh

- Eternal Connection of the Jews and Temple Mount

- Ethan Bortnick

- Ethics of using medical data derived from Nazi experiments

- Ethiopian Jews

- EU’s Red Baroness Ashton

- Europe Judenrein

- European 'No-Go' Zones for Non-Muslims Proliferating

- Excluding Jews from Arab Juries

- Exodus

- Expel Arabs From Israel

- Exposing Anti-Israel Boycotts

- Exposing Iran's Nuclear Archive

- Expulsion of the Jews from Muslim Countries

- Eyal Golan

- Ezra Levant

- Facebook's “Kill A Jew Day”

- Fake Gaza "children's art" hypocrites bar Zionists from show

- Fallacy of moral equivalence

- falsely blaming Israel for Gaza power woes

- Family Guy

- Fast Train to Jerusalem

- Fatah honored 12 terrorists responsible for murdering 95 people

- Fatah leader curses those who sell land to Jews

- Father Patrick Desbois

- FBI's shameful recruitment of Nazi war criminals

- Female Mossad Agents

- Fiamma Nirenstein

- Fiddler on the Roof

- FIDF

- Fifty Years of Jerusalem’s Reunification

- Fighting the spread of Islam

- Financial Corruption of the Palestinians

- Financial Links Uncovered Between Hamas and Gaza Flotilla Organizers

- Five Stages of Islam that threaten the fundamental freedoms of Western Democracy

- Flame cyber-attack on Iran

- Florida Security Council

- Flotilla is a tactic in a larger war there the goal is to undermine Israel

- Flying Camel Squadron

- Forced underage marriage

- Foreign Envoys getting hurt in Gaza

- Former Saudi Royal Navy Commodore Abdulateef Al-Mulhim

- Forty Shades of Grey

- Fountainheads

- France Penalizes Boycott of Israeli Products

- France’s consul general in Jerusalem of denying Jewish connection to the Land of Israel

- Frank Miller

- Frank Sinatra

- Fred Taub

- Free Palestine is code for kill the Jews

- Free Palestine means free Palestine from every Jew

- Freedom of speech is just about non-existent in Islam

- Friend-a-Soldier

- Friends for Health

- Friends of Israel Initiative

- funny

- Fyvush Finkel

- Gabi Ashkenazi

- Gad Elbaz

- Gadi Aviran

- Gal Gadot

- Gavin Boby

- gaza

- Gaza Expulsion Did Psychological Harm to IDF Soldiers

- Gaza Flotilla

- Gaza Fly-In Flotilla

- Gaza Fly-Ins

- Gaza terror groups brag about bombing civilians. @HRW and @Amnesty completely silent on admitted war crimes.

- Gaza terrorists get weapons and training from Iran

- Gaza Terrorists use Google Earth to Pinpoint Targets

- Gaza’s Miseries Have Palestinian Authors

- Gazan civilians may have been killed by their own rockets

- Gazans Cheer as Rockets are Fired at Israel

- Gazans using children as props - and as human shields

- Gedolei Yisroel

- Geert Wilders

- George Shultz

- George W. Bush

- Ger

- Gerald Steinberg

- Geraldine Ferraro

- German Anti-Semitism

- Germany banning circumcision

- Gershon Veroba

- Get Smart

- Gilad Erdan

- Gilad Schalit

- Gilo

- Girl's poem repeats PA libel that Israel murdered Arafat

- Giulio Meotti

- Givati Brigade

- Glenn Beck

- Glorifying Arab Terrorist Murderers

- God is Protecting Israel

- God on Trial

- Golani Bigade

- Golda Meir

- Golden Gate

- Golden Gate -- Sha'ar Harachamim

- Goldstone Commission Report

- Google Israel

- Google Palestine

- Google Says Gush Etzion Residents Live in 'Palestine'

- Google's Street View comes to Israel

- Grand-Mufti

- Greece puts halt to Gaza flotilla

- Greece took a very brave stand against the Gaza Flotilla

- Guide Dog Center for the Blind in Israel

- Guma Aguiar

- Gush Katif

- Gustav Bauernfeind

- Gutter Anti-Semitism at the Free Gaza Movement

- Guy Tzvi Mintz

- Gvozhitz

- Hadassah Medical Organization

- Haim Saban

- Hala Hijazi

- Halacha

- Haliba

- Hamad bin Khalifa

- Hamas

- Hamas and Israel's Border

- Hamas bans all contact with Israeli media

- Hamas Booby Trapped School and Zoo

- Hamas Caught Placing Children on the Front Line

- Hamas counts on Jewish compassion to compensate for their weakness

- Hamas cracks down on free speech and freedom of the press

- Hamas firing rockets from densely populated areas

- Hamas Fundraising

- Hamas hides rockets and explosives in underground tunnels in Gaza

- Hamas incites violence to hide its own shortcomings

- Hamas instructs Gazans on propaganda "Always call people 'innocent civilians"

- Hamas invests in its terrorist infrastructure instead of civil infrastructure for Gaza's residents

- Hamas Killed 160 Palestinian Children to Build Terror Tunnels

- Hamas Media Strategy Relies On Deaths Of Civilians

- Hamas Needs the Palestinians' Deaths in Order to Claim Victory

- Hamas official says the group wants to slaughter every Jew in the world

- Hamas Propaganda

- Hamas recruiting children to fight Israel

- Hamas Shoots Rockets from SchoolS and Cemeteries

- Hamas shot rockets from church

- Hamas Terrorist Tactics in the Gaza Strip

- Hamas Terrorists Firing Rockets on Israel from Houses in Gaza

- Hamas use of human shields endangers Israeli lives

- Hamas uses journalists as human shields

- Hamas using children as human shields

- Hamas using WhatsApp to intimidate Israelis

- Hamas wants to avoid reconciliation with Abbas

- Hamas war crimes

- Hamas: We Place Civilians in the Line of Fire

- Hamas’ dead baby strategy works because the media facilitates it

- Hamas' Illegitimacy

- Hamas' M-75 Perfume

- Hamas' M-75 Rockets

- Hamas’s Use of Civilian Areas as Missile Bases

- Hannibal Protocol

- Hanoch Teller

- Har HaBayis

- Har Hazeisim

- Har Homa

- Har Nof Massacre

- Harav Abraham Isaac Kook

- Harav Avigdor Nebenzahl

- HaRav Baruch Sorotzkin

- HaRav Chaim Kanievsky

- HaRav Chaim Pinchas Scheinberg

- Harav Michel Yehudah Lefkowitz

- HaRav Moishe Shternbuch

- HaRav Moshe Feinstein

- HaRav Pinchos Friedman

- HaRav Shlomo Halberstam

- HaRav Simcha HaKohein Kook

- HaRav Yaakov Kamenetsky

- HaRav Yitzchak Zev Soloveitchik

- HaRav Yitzchok Ruderman

- HaRav Yosef Shalom Eliyashiv

- HaRav Yoseph Chaim Zonnenfeld

- HaRav Zev Leff

- Harley Davidson salute to IDF

- Harley Davidson tour of Israel

- Harry Maryles

- Harry Potter a Zionist Plot to Promote Devil Worship

- Harry Truman

- Harry Truman's Recognizing the new State of Israel

- Hashem gave Eretz Yisroel to the Jews

- HaShomer HaHadash - The New Guardian

- Hasidism in America

- Hassen Chalghoumi

- Hatch-Lieberman resolution

- Hatikvah

- Hating Israel means hating USA

- Hatzalah

- Hatzola of Los Angeles

- Hava Nagila

- Haym Solomon

- he's not safe in Brooklyn

- Heartbeat

- Hebrew University Bombing

- Helen Thomas

- Henoch Messner

- Henry Kissinger

- Herman Cain

- Herodion

- Hesder Yeshiva Boys serving in the IDF

- Hezbollah

- Hezbollah has around 550 underground bunkers throughout Lebanon

- Hezbollah set up a vast network of weapons caches in homes hospitals and even underneath children's playgrounds

- Hezbollah traffics cocaine and heroin to fund terrorism

- Hezbollah uses unarmed civilians to hide their weapons

- Hezbollah's Fake Environmental Organization

- Hezbollah's propaganda war

- Hezbollah's terror theme park

- Hijacking Holocaust Remembrance

- Hillary Clinton pro-Moslim agenda

- Hillel Neuer

- Hillel Palei

- Hindy Cohen

- Historic Torahs

- Hitler products

- Hitler Youth

- Hitler’s will and political testament

- Hizballah in America

- Hizbullah

- Hollywood actors converting to Judaism

- Hollywood supporting Israel

- Holocaust

- Holocaust Denial

- Holocaust Survivors

- Homosexuality and the rape of young boys is rampant among female-starved Arab Muslim men

- Honest Reporting

- Honor Killings

- HORSE

- Hoshana Raba

- How AIPAC is Betraying Israel

- How anti-Israel bias creeps into the mainstream media

- How Arabs win the PR war

- How Are They an Obstacle to Peace?

- How can we expect the secular media to report on Israel accurately

- How come the UN Security Council is not condemning this?

- How do we expect the secular media to portray Jews and Israel positively

- How do we expect the secular media to portray Jews and Israel positively when the Jewish Journal of Los Angeles does not?

- How Israel Rules The World Of Cyber Security | VICE on HBO

- How Palestinians can kill their daughters sisters and wives and get away with it

- How poorly the US had Israel's back during the 1991 Gulf War

- How Small Israel Really Is

- How the Jewish State of Israel was founded in 1948

- How to Speak to the Muslims

- Huge gap between the rich and the poor in Moslem countries

- Huma Abedin's ties to Moslem Brotherhood

- Human Rights violations of the Palestinian Authority

- Human Shields

- Humiliation of Palestinian Refugees by arabs

- Humiliation of Palestinians in Arab States

- humir

- humor

- Hunting down Nazis

- hypocrisy

- Hypocrisy alert Lebanon almost finished building a wall

- IAF

- IAF Drops Flyers Telling Residents Of Certain Areas Of Gaza To Evacuate

- IDF

- IDF lawfully enforces a naval blockade on the Gaza Strip

- IDF and “Settlers” Rescue Arab Mother and Baby

- IDF boots are stitched together by Palestinian Arabs

- IDF bringing back Jews wounded and killed by terrorism in foreign countries

- IDF Chief Cantor

- IDF Chief Cantor Lt. Col. Shai Abramson

- IDF Creates Field Hospital for Injured Palestinians

- IDF drops leaflets on Gaza warning residents to stay away from border

- IDF drops leaflets to Palestinians

- IDF is the greatest army in the world

- IDF is the most moral army in the world

- IDF Orchestra

- IDF providing humanitarian aid to disaster countries

- IDF Re-Arrests Shalit Deal Terrorist

- IDF recruits trees for home defense

- IDF Redirects Attack to Avoid Civilian Casualties

- IDF releases video urging soldiers not to post secret information online

- IDF religious exemption

- IDF Reservists

- IDF safeguards civilians

- IDF Shayetet 13 naval commandos

- IDF should not conduct a ground invasion into Gaza

- IDF Soldiers Find Gaza House Rigged with Explosives

- IDF Soldiers Uncover Tunnel Used for Terror in Gaza

- IDF's aggressive social media strategy

- IDF's Air Mule

- IDF's Code of Ethics

- IDF's combat cameraman unit

- IDF's ethics during Operation protective Edge

- IDF's Human Intelligence Division

- IDF's Military Underground Intelligence Unit 8200

- IDF's weapon seizures from Arabs

- If a Jew is not safe in Chevron

- If Arabs want to be Shahid martyrs why do they seek revenge for the Shahid's death?

- If Sderot cannot sleep then the Arabs won’t sleep in Gaza either

- If Settlements Are Only 1.1% of West Bank

- If the Arabs were to put down their weapons there would be no more violence - if the Jews put down their weapons

- If there were no Jews in Israel

- If you want "peace in the Middle East

- Ignoring Saudi abuses

- iKotel

- Ilan Ramon

- Ileana Ros-Lehtinen

- Illegal Arab Settlement

- Illegally built mosques

- Imam Abdallah Adhami

- Imprisoned Arab terrorists do not regret their acts of terror and murder

- Improperly Comparing Israelis to the Nazis

- In 1936 when Nazi central figures vowed to "exterminate" Jews; it was buried on NYT page 14

- in fact

- In Our Hands - Brings Liberation of Jerusalem to Life

- Inconvenient Truths About Gaza

- Innocent Palestinians protesting peacefully

- Instructions on Facebook to Gazans for “March of Return”

- Intergalactic Zionist Conspiracy

- International Committee on Har Hazeisim

- Internet Terrorism

- Interrupting Pro-Israel Speakers at college campuses

- Intifada of Graves

- Introducing Eliezer Kosoy and Yonason Hill

- Iqbal al Yahud

- Ira Heller

- Iran admits lying to IAEA about its nuclear program

- Iran celebrating Obama's reelection

- Iran covering up nuclear test site

- Iran creates festival to countdown Israel's destruction within 25 years

- Iran gave Hamas the Fajr 5 Rocket

- Iran Had An Ongoing Nuclear Program

- Iran in the UN Security Council

- Iran insults Israel

- Iran is considering deliberately spilling oil into the Persian Gulf in response to international sanctions against it

- Iran smuggling weapons into Gaza

- Iran Will Be Next Chernobyl

- Iran-sponsored terrorism

- Iran's abuse of womens' rights

- Iran's Fateh-110 Conqueror short-range ballistic missle

- Iran's Gender Apartheid

- Iran's horrible human rights record

- Iran's incitement to genocide

- Iran's Jewish Community

- Iran's Jews in danger

- Iran’s targeting Israelis abroad

- Iran's terror attack on an Israeli tour bus in Bulgaria

- Iran's time machine

- Iranian American Jewish Federation of Los Angeles

- Iranian Anti-Semitism

- Iranian conspiracy theory about Facebook

- Iranian Government Stirs Up Anti-Semitism

- Iranian Government Stirs Up Anti-Semitism with Invented Massacre by Queen Esther and Mordechai

- Iranian government's execution binge

- Iranian Jewry

- Iranian naval vessels to be deployed near U.S. sea borders

- Iranian Nuclear Threat

- Iranian Official Hossein Amir-Abdollahian Threatens to "Raze Tel Aviv and Haifa to the Ground"

- Iranian sponsored terrorism

- Iranian Support of Terrorism

- Iranium

- Iraq Genocide

- Iraqi's Scud Missiles to Israel

- Iron Dome

- Iron Dome Alliance

- Iron Dome anti-rocket system

- IRS scrutiny of applications for tax-exempt status by pro-Israel groups have been undertaken at the behest of the 'Palestinians

- IRS Targeted Supporters of Israel’s Disputed Territories

- Irwin Cotler

- is

- Isaac Honig

- Isaac Yitzchak Bitton

- ISIS is to America as Hamas is to Israel

- Islam actively suppresses and even prohibits the practice of other religions

- Islam is Most Violent Religion

- Islam is not a religion of peace

- Islam proclaims itself as the only legitimate religion

- Islam rejects human rights

- Islam's Stranglehold on Israel

- IslamBerg

- Islamic Bombing of the Boston Marathon

- Islamic Fundamentalism is the Real Enemy

- Islamic Intolerance

- Islamic Jihad

- islamic religious law against the Jews

- Islamic solidarity is a myth

- Islamic terror

- Islamic Terrorists

- Islamification of America

- Islamification of Europe

- Islamist Indoctrination of Children With Antisemitism

- Islamist version of freedom

- Islamists hate America

- Islamization of Europe

- Islamonazism

- Islamophobia

- Israel

- Israel acts according to International Law

- Israel being in the front lines protecting the US against Syrian and Iranian weapons of mass destruction

- Israel belongs to the Jews

- Israel Buys Azerbaijan Air Field on Iran's Northern Border

- Israel can save the Middle East

- Israel cannot allow over one million citizens to live in bomb shelters

- Israel cannot rely on the United States for its security

- Israel Christian Nexus

- Israel Day at the New York Stock Exchange

- Israel Dealing with Terrorism

- Israel does not control the State Department

- Israel excluded from the first meeting of the Global Counter-terrorism Forum

- Israel extradited criminals to the US

- Israel Flying Aid

- Israel Forum for International Humanitarian Aid (IsraAID)

- Israel Friendship League and the Israel - America Chamber of Commerce

- Israel had no intention of capturing Jerusalem’s Old City when the Six-Day War began 45 years ago

- Israel Has an Historic Right to Judea and Samaria

- Israel Has Launched Long-Shot Attacks Before

- Israel Hate-Fest

- Israel IQ

- Israel is a country which is misunderstood and misrepresented

- Israel is a Foreign Aid Power

- Israel is a Jewish State

- Israel is not an apartheid state

- Israel is the litmus proof

- Israel is using missile defense to protect its civilians and Hamas is using their civilians to protect their missiles

- Israel is What's Right about the Middle East

- Israel isn't the enemy of the Arabs

- Israel keeps Holocaust memories alive

- Israel Land Fund

- Israel makes sacrifices for peace

- Israel Must Have a Death Penalty For Terrorists

- Israel must stop apologizing

- Israel preventing injury to innocent civilians

- Israel releasing arab terrorists

- Israel releasing thousands of terrorists in exchange for Gilad Schalit

- Israel selling weapons to Arab countries

- Israel sends aid to Hurricane Sandy victims

- Israel should hire a public relations firm

- Israel Shouldn’t Rely on the U.S. for Its Security

- Israel sold military equipment to Arab and Muslim countries

- Israel supplying humanitarian aid to Arabs

- Israel supports US security

- Israel Targeted Gaza Civilians with Humanitarian Aid Israel “targeted” Gaza civilians with humanitarian aid while Gaza terrorists committed war crimes by firing missiles on Israelis

- Israel to deploy new intelligence battalion on Egyptian border

- Israel to promote itself on Facebook

- Israel trumps the Arab world

- Israel Walks Out on Ahmadinejad at UN

- Israel Warning Palastinians Before Bombing

- Israel was excluded from the International Red Cross for half a century because of the Star of David

- Israel will not sign contracts with Europe so long as it continues to boycott areas beyond the 1949 Armistice Line

- Israel won’t play Russian Roulette with its citizens’ lives

- Israel-Egyptian Peace

- Israel-haters

- Israel-hating sheikhs invited to White House

- Israel-Russian connection

- Israel’s achievements in women’s and minority rights an inspiration to the Muslim world

- Israel's agricultural achievements

- Israel's agricultural achivements

- Israel's Best Friend

- Israel's Bombing of Iraq's Nuclear Reactor

- Israel's Canine Defense Team

- Israel's credit rating

- Israel's critical need for defensible borders

- Israel's Critical Security Needs

- Israel's Doctrine of Proportionality in Gaza

- Israel's Enemy is America's Enemy

- Israel's goodwill gestures to the Arabs are never reciprocated

- Israel’s Heroic Restraint

- Israel’s humanitarianism

- Israel's International Bible Quiz

- Israel's Legal Right To Judea and Samaria

- Israel's medical achievements

- Israel's Military Justice System in Times of Terror

- Israel's Military Superiority

- Israel's Oil

- Israel's Prime Ministers

- Israel's Response to Nuclear Iran

- Israel's right to build it's country

- Israel's right to defend itself

- Israel's right to exist

- Israel's Right to Nuclear Power

- Israel's Right to Survive

- Israel's Rights as a Nation-State

- Israel’s social media war

- Israel's Support of the Palestinian Economy

- Israel’s terrorism prevention security fence

- Israel's water conservation

- Israel's welfare is in the best interest of the United States because Israel is the front line against the Arabs

- Israeli Airstrike on Iraqi Nuclear Reactor 1981

- Israeli ambassador to UN puts Tehran and Ramallah on notice

- Israeli arab terrorists

- Israeli arabs favor Intifadas against Israel

- Israeli arabs want all the social welfare benefits of being part of the Jewish state with none of the obligations

- Israeli army protecting Palestinians

- Israeli Astronauts

- Israeli athletes

- Israeli athletes murdered at the Olympics in Munich

- Israeli Bereaved Parents coping with their grief

- Israeli bus line no longer allows Palestinians and Jews to travel together.

- Israeli children living in fear because of Arab bombing Israeli cities

- Israeli courage

- Israeli currency during Palestine

- Israeli Day Parade

- Israeli Democracy

- Israeli Diamonds

- Israeli Economy

- Israeli embassies

- Israeli flag flying on top of the Dome of the Rock

- Israeli flag incites riots among Arabs

- Israeli Horse Riders

- Israeli hospitals treating arab patients

- Israeli Humor

- Israeli Justice

- Israeli law must be applied to the Temple Mount

- Israeli military intelligence

- Israeli millionaires

- Israeli Navy intercepting weapons headed for terrorists

- Israeli Opera Festival

- Israeli police selectively enforcing law on Har Habayis

- Israeli Prime Minister's Torah Class

- Israeli Remembrance Day

- Israeli Saudi Arabia connection

- Israeli soldiers who died protecting Israel

- Israeli solidarity with the Syrian people calling to stop the massacre

- Israeli stamps

- Israeli surgeons treat Palestinian girl while under fire from Gaza

- Israeli technological achievements

- Israeli TV

- Israeli Victims of Arab Terror

- Israeli wines

- Israeli-Palestinian Conflict Not the Root of the Region's Problems

- Israelis are more prosperous than the Palestinians

- Israelis are so much more economically successful than Palestinians

- Israelis supporting USA

- Israelis vs Palestinian fertility rate

- Israellycool

- It's 1938 and Iran is Germany

- It's Time to Delegitimize the Delegitimizers

- It's time to repeal Oslo

- Itamar Marcus

- Itamar Massacre

- Itzak Orlev

- Itzhak Perlman

- Itzik Orlev

- Ivanka Trump

- Izak Parviz Nazarian

- J Street corruption

- J-Street has harmed Israel

- Jack Lew

- Jackie Mason

- Jaffa Gate

- Jamie Geller

- Jan Karski

- Jan Schakowsky

- Japan's nuclear crisis and Iran's pursuit of a nuclear weapon

- Jared

- Jarrod Jordan

- Jason Greenblatt

- Jawaher Abu Rahmah did not die as a result of inhaling tear gas fired by IDF soldiers

- JDL

- Jeane Kirkpatrick

- Jeff Ballabon

- Jeff Jacoby

- Jeffrey Goldberg

- Jeremy Gimpel

- Jerome Schottenstein

- Jerusalem (Al Quds) is not mentioned in the Quran even once

- Jerusalem Arabs Want To Live Under Israeli Rule

- Jerusalem Conference

- Jerusalem Day

- Jerusalem Day 2017 – Movie “In Our Hands” Brings Liberation of Jerusalem to Life

- Jerusalem flash mob dance

- Jerusalem invests millions in Arab schools

- Jerusalem is Israel's eternal capital

- Jerusalem is not a settlement

- Jerusalem is that it is a fully-functioning intercommunal city

- Jerusalem is the Capital of Israel

- Jerusalem Light Festival

- Jerusalem Light Rail

- Jerusalem Marathon

- Jerusalem Reclamation Project

- Jerusalem Segway

- Jerusalem's Temple/Jewish history denied

- Jerusalem's tram

- Jerusalem's Woodstock Revival

- Jeunesse Twins

- Jew Bashing

- Jew Direction

- Jewbilation

- Jewish access forbidden in certain Arab areas of Israel

- Jewish actors

- Jewish blood is not cheap

- Jewish Canadians joining Israeli army

- Jewish Communities

- Jewish doctors treating Arabs

- Jewish Entertainers

- Jewish history in Land of Israel erased

- Jewish immigrants settled Eretz Yisroel

- Jewish Jerusalem

- Jewish justices

- Jewish land seized in Arab countries

- Jewish mosque in the Jewish quarter

- Jewish music

- Jewish Nobel Prize

- Jewish Persecution in Egypt

- Jewish pilgrimages to burial places of Tzaddikim buried in Arab countries

- Jewish prodigy

- Jewish Witchcraft

- Jewish women should not be married to Arab Muslim men

- Jewish Zealotry

- JEWNIVERSE

- Jews always existed in Israel

- Jews are the Smartest Population of People

- Jews banished from Arab land

- Jews barred from Arab states

- Jews being banned from praying at the Temple Mount

- Jews buying land of Israel from Arabs

- Jews Cannot Coexist with Arabs

- Jews cannot enter Arab villages

- Jews control the media

- Jews didn't kill Christ

- Jews do not live in "spacious villas"

- Jews living in arab countries

- Jews living peacefully with non-Jews

- Jews of Kaifeng China

- Jews should not drive German cars

- Jews walking to the Kotel on Shabbos

- Jews were exiled from Arab countries

- Jihad against Israel

- Jihad denial

- Jihad is Against the Bible

- Jihad Watch

- Jihadi funeral celebration

- Jimmy Carter

- JNF-KKL

- JNF: Making the Israel Desert Bloom

- Jo Amar

- Joe Biden

- Joe Walsh

- Joel Pollak

- John (Ivan the Terrible) Demjanjuk

- John Baird

- John Boehner

- John Bolton

- John F. Kennedy

- john hagee

- John Kerry

- John McCloy

- Jon Lovitz

- Jon Stewart

- Jon Voight

- Jonathan Pollard

- Jonathan Rosenblum

- Jordan is Palestine

- Jordan says Jews on the Temple Mount "hurts Muslim feelings"

- Jordan wants Israel on its border

- Jordan's custodianship of the Temple Mount

- Jordan's Queen Rania

- Jordanians sexually abuse Palestinian children

- Jordon is Palestine

- Jose Maria Aznar

- José María Aznar

- Joseph Lieberman

- Joseph's Tomb

- Journalists Accepting Bribes from Arab Dictators

- Journalists use terrorists to generate news

- Joyce Kaufman

- Juan Williams

- Judah P. Benjamin

- Judaica

- Judea and Samaria Are Not Occupied Territories

- Judea and Samaria: a mountain of security

- Judea Brigade

- Judge Ruchie Freier

- Judy Gruen

- Julie Andrews

- Julius Streicher

- Jumanah Imad Albahri

- Justice Menachem Elon

- JWR

- Kach

- Kahane was Right

- Kaliver Rebbe

- Kaparos

- Karate Master Israeli Prison Chaplin Rabbi Fishel Jacobs

- Kareem Abdul-Jabbar

- Kashou Rebbe

- Kasim Hafeez

- Kassam rockets

- Ken Burgess

- Ken O'Keefe

- Kenneth Meshoe

- Kerry’s Collusion with Iran

- Kever Rochel

- Kever Rochel is not a mosque

- Kever Yosef

- Kfar HaShiloach

- Khaled Abu Toameh

- Khalid Sheik Mohammed

- Khaybar

- Kibbutz Lavi

- Kibbutz Sasa

- Kiddush Hashem

- Kidnapping Israeli Soldiers

- Kidnapping of Eldad Regev and Ehud Goldwasser by Hezbollah

- Kids in Gaza schools learning to kill Jews

- Kids of Courage

- Kill people who are trying to kill you

- Kill the Jews Rally

- Killing Jews is worship that draws Arabs closer to Allah

- Killing Terrorists

- Kinderlach

- King David

- King David's Tomb

- King of Morocco

- Kippah is the True Iron Dome

- Kiryat Sanz Laniado Hospital

- Kiss rocker Gene Simmons

- Kisufim Trio

- Klausenberger Rebbe

- Klezmer

- Knesset Bans Smoking at the Kosel

- Knesset Guard's special forces units

- Koby Mandell

- Kollel & Kiruv Center in Auschwitz

- Koran is anti-semitic

- Korban Pesach Group

- Koreans learning Talmud

- Kosher Products

- Kosov

- Kotel HaKatan

- Krav Maga

- Krias Yam Suf

- Kristallnacht

- Kuppy Elbogen

- Kurt Waldheim

- Kuwait Airways can ban Israeli passengers

- LA Times Ignores Extensive Arab Construction in Jerusalem

- Labeling ‘Settlement’ Imports

- Lack of Palestinian traditions and morals

- Ladislaus Csizsik-Csatary

- Lag Ba'Omer

- Land for War

- Land of Israel Movement

- Land of Milk and Honey and Oil

- Lara Logan

- Larry Elder

- Larry Miller

- LATMA

- Lauren Booth

- Lazer Lloyd

- Leah Veffer

- Lebanon and Syria refuse to accept Palestinian passports

- Lee Habeeb

- Lehava

- Leon Klinghoffer

- Leonard Garment

- Leonardo Farkas Klein

- Lev Tahor

- Lev Tahor Cult

- Levi Eshkol

- Levy Falkowitz

- Levy Report

- Liberal Left hates the Settlers

- Liberal media sides with Hamas over Trump

- Liberation of Jerusalem

- Liberators of concentration camps

- Libyan leader Muammar Qaddafi had Jewish roots

- Lies of the Boycott Divestment of Israel

- Lies outweigh facts in Palestinian Arab media

- Lieutenant Meyer Birnbaum

- Lieutenant Sacha Dratwa

- Lieutenant Tzvi Yehuda Mansbach

- Life in Israel

- Life magazine argued against a Jewish state in 1946

- Lindsey Graham

- Lipa Schmeltzer

- Listen to what the 'Palestinians' are saying in Arabic

- Living under an Arab-Muslim regime for a while might change your mind about Israel

- London School of Jewish Song

- Lone Soldiers of the IDF

- Lopsided casualty counts don't dictate morality

- Lori Palatnik

- Louis Farrakhan

- Love for Israel

- Lt. Daniel Mandel

- LTC Allen West

- Lubavitch

- Lubavitcher Rebbe

- Luke Ford. Self-Hating Jews

- Lunatic fantasies from the Islamic world

- Ma'alot tragedy

- Ma'arat HaMachpelah

- Maaleh Zeitim

- Maarat Hamachpelah is not a mosque

- Maccabeats

- Machon HaMikdash Institute

- Madrid Conference

- Magen David Adom

- Mahmoud Abbas is personally responsible for the high salaries to terrorists

- Maimonides

- Maj. Itamar Abu

- Making The White House Kitchen Kosher

- Malcolm Hoenlein

- Mandate for Palestine

- Mandelbaum Gate

- Map distributed to Gaza rioters via Facebook directing them to breach the fence and infiltrate nearly Israeli communities

- Mapping Every Tombstone of Har HaZeitim

- Maran Hagon Rav Yosef Sholom Elyashiv

- Marc Chagall

- Marcello Pera

- March Around the Ancient Walls

- March of the Living

- Mark Golub

- Mark Kirk

- Mark Langfan

- Mark Schiff

- Mark Twain

- Martin Luther King was a Zionist

- Marvin Silbermintz

- Marwan Barghouti

- Masada

- MASHAV

- Massacre at Mossad HaRav Kook

- Mattisyahu

- Mavi Marmara

- Max Webb

- Maybe it's time to realize that Israel is on its own

- Mayim Bialik

- Mayor Carlos Gimenez

- MBD

- mbs

- MBY

- Media advocacy for Israel

- Media Bias Against Israel

- Media fawning over Arab leaders

- Media portraying brutal Arab dictators as family men

- Media Whitewashed ‘Terrorists’ in Shalit Deal

- Medical clowns in Israeli hospitals

- Meet an Israeli? Kill Him

- Megama Duo

- Meir Dagan

- Meir Goldberg

- Mel Gibson's anti-semitic rant

- Melanie Phillips

- MEMRI

- Menachem Begin

- Menachem Begin Heritage Center

- Menachem Herman

- Menachem Moskowitz

- Menachem Weinstein

- Mendy Werdyger

- Mercava

- Mercaz HaRav Kook Tragedy

- Mercaz HaRav Tragedy

- Merkava Mk 4 Tank

- Meshorerim Choir

- Meydad Tasa

- Mezamrim Choir

- mi keam

- Mi Keamcha Yisroel

- Mich Cohen

- Michael Coren

- Michael Gerbitz

- Michael Helfand

- Michael Ian Elias

- Michael Medved

- Michael Oren

- Michael Savage

- Michael Steinhardt

- Michael Widlanski

- Michelle Bachmann

- Michoel Streicher

- Micky Marcus

- Migdal Ha'Emek

- Migron

- Mike Harris

- Mike Huckabee

- Mike Pence

- Mike Pompeo

- Militant-Islam

- Million Muslim march

- Miral

- Miriam Peretz

- Miseries of the Arabs

- Mishel Cohen

- Mishmeret Yesha

- Misusing the Holocaust to justify Israel's existence

- Mitch McConnell

- Mitchell Flint

- Mitt Romney

- Mitt Romney's visit to Israel

- Mitzpeh Yericho

- Mizumen

- Moderate Moslems?

- Modi Rosenfeld

- Modzhitz

- Moishie Holzberg

- Moment of silence for the 40th anniversary of the Munich Olympics

- Mona Eltahaway

- Mordechai Friedman

- mordechai kedar

- Mordechai Rosenstein

- Mordechai Shtimentz

- Mormon baptism of dead Jews

- Mort Klein

- MortZuckerman

- Mosab Yousef

- Moses Miracle

- Moshav Band

- Moshava

- Moshe Arens

- Moshe Dayan

- Moshe Feiglin

- Moshe Giat

- Moshe Kahlon

- Moshe Kasher

- Moshe Mandelbaum

- Moshe Storch

- Moshe Yess

- Moshiach

- Moslem co-wives

- Moslem Hatred on the Temple Mount

- Moslem version of the Cosby Show

- Moslems claim thatHurricane Sandy was a divine punishment for a film mocking the prophet Mohammed

- Moslems converting to Judaism

- Moslems desecrate Cave of Machpeilah

- Moslems do not condemn terrorism

- Moslems getting virgins in heaven

- Moslems shutting down streets to pray

- Moslems upset when world leaders visit the Kotel

- Moslems who cheat on their fasts on Ramadan

- Moslim Zionists

- Mosque at Ground-Zero

- Mosque’s Loud Prayer

- Mosques finance terrorism

- Mosques Teach Violence

- Mossad agents smuggled half a ton of top-secret records from Iran’s nuclear program from Tehran to Israel

- Mossad Systematically Killing Iranian Nuclear Scientists

- Mossad training Iranian exiles in Kurdistan

- Motta Gur

- Mount of Olives

- Mount Zion

- Movies in Israel

- Movies that depict Israel in a good light

- Mrs. Al Qaeda

- Muammar Gaddafi

- Mughrabi Gate

- Mumbai Massacre

- Munkatch

- Musicians boycotting Israel

- Muslim Brotherhood

- Muslim Brotherhood’s Torture Chambers

- Muslim Brotherhood's You Will Not Cross My Land campaign

- Muslim children play soccer on the site of the Dome of the Rock

- Muslim clerics instruct community in eastern Jerusalem to refrain from selling property for fear of it being transferred to Jews

- Muslim on Muslim violence

- Muslim right not to be offended is more important than human rights of Jews

- Muslim Students Association pledge of allegiance

- Muslim Terrorist War against Israeli Families

- Muslim Women Block Jews from Temple Mount

- Muslim women smuggling weapons under their clothing when visiting Temple Mount

- Muslims bow in prayer with their face to Mecca and their backsides to Al Aksa mosque

- Muslims burn down Churches

- Muslims harass Jews on Temple Mount

- Muslims upset at Kotel museum exhibit in Brooklyn

- Muslims4UK

- Myth of the Palestinian Underdog

- MYTH: "Palestinian terrorism is a byproduct of the 'cycle of violence' perpetuated by Israel."

- Na’ama Gavish

- Naava Applebaum

- Nachal Chareidi

- Nachshon Wachsman

- Nachum Segal

- Naftali Bennett

- Naftali Kalfa

- Naftali Kalka

- Nahal Dragot

- Nahal Reconnaissance Unit

- Nakba is a self-inflicted catastrophe by the Arabs

- namely the freedom to hate and persecute Jews

- Napoleon Bonaparte

- NASCAR Team Races for Israel

- Nat Lewin

- Natan Epstein

- Natan Sharansky

- Nathan Diament

- National Council of Young Israel

- Navi-Prophet School

- Nazi art

- Nazi children serving in the IDF

- Nazi Doctors

- Nazi Romance With Islam

- Nazi-Theme Café

- NCSY

- Nefesh B’Nefesh

- Nefesh BeNefesh

- Neil Boortz

- Neil Diamond

- Neil Lazarus

- Nel Burden

- Neo-Nazi Skin-Heads

- Nesivos Shalom

- Netanyahu’s Vision for the Middle East Has Come True

- Neturei Karta Mamzerim

- Netzah Yehuda IDF unit

- NEVER AGAIN

- Never Was

- New York Boys Choir

- New York Times criticizes Israel for trying to save Arab lives

- Newt Gingrich

- Next Year in Jerusalem

- NGO Monitor

- Nicky Larkin

- NightOwls

- Niki Haley

- Nikki Haley

- Nikolsberg Rebbe

- Nir Barkat

- Niso Shacham gave orders to his policemen to use excessive violence against the unarmed civilians protesting against the evil order to expel all the Jews from Gush Katif

- Nissim (Damian) Black

- Nissim Black

- Nitsana Darshan-Leitner

- No Country Gives Enemy Electricity in Wartime

- No democracy among Arabs

- No freedom of press in militant Islamic countries

- No is the real obstacle to peace

- No Islam in Japan

- No moral equivalency between Hamas & Israel

- No Nation "Would Sit There While Rockets Are Bombarding It"

- No One is as Spoiled as Israel's Arabs

- No Palestinian right of return

- No Palestinian State

- No preconditions to peace talks

- No recognition of a unilateral Palestinian State

- No Terror Swap

- Noah Pollak

- Nof Zion

- Noiky Roberts

- Noisy mosques and churches

- Nonie Darwish

- Norm Finkelstein

- Norway's anti-Israel boycott

- not to hate and kill

- not what they are saying in English

- Not Without My Daughter

- November 29

- NPR Muslim Brotherhood Investigation

- Nuclear Duck

- Nuremberg

- Obama - The Anti-Israel President

- Obama Admits He Is A Muslim

- Obama Can't Bring Himself To Console Israel Without Whitewashing Palestinian Terrorism

- Obama cutting Israeli joint missle defense programs

- Obama failed to visit Israel while President of the United States

- Obama gravitates towards Jew-haters and Israel bashers

- Obama may be losing the faith of Jewish Democrats

- Obama Urged to Cut Ties with Muslim Brotherhood

- Obama's double standards for Israel

- Obama's failed Mid-East Peace Plan

- Obama's Jews

- Obama's reticence to confront Palestinian intransigence

- Obama's trip to Israel

- Obama’s View of Jerusalem ‘Un-American’

- Occupation glasses

- Occupied vs Disputed territories

- Occupied vs Disputed" territories

- Occupy Wall Street Movement and Anti-Semitism

- OCID Obsessive Compulsive Israel Disorder

- Octopus - Iran's terrorist Quds Force

- Oday Aboushi

- OECD Privacy Conference 2010

- Ofer Merin

- Ofer Vinter

- Ohad Moskowitz

- OLAM magazine

- Old City of Yerushalayim

- Olive Tree Initiative